93% of those surveyed in this report attempted to recruit staff over the past 12 months. Engineering, Sales, Finance, and Manufacturing were the sectors where businesses were experiencing the most difficulty in recruiting.

The report also provides a summary of the options that businesses, who are looking to supplement lower salaries with a strong benefits package, currently offer. This is demonstrated by the fact that 75% of companies offer working from home, and 78% offer flexible start and finish times. This is a result of a change in how certain employees are thinking and are fitting their work around their personal lives and consider flexible working and annual leave allowance just as important as their salary. It has never been more crucial to compare the salary and benefits that your business offers in order to attract and retain staff. We can also see more companies are offering benefits this year compared to last, as 83% of companies in this report offer free training to employees, compared to 78% last year and 55% of companies offer enhanced sick pay compared to 45% last year.

Alongside recruitment and retention difficulties, businesses are also facing numerous challenges due to the rising cost of living driven by a rise in food and material prices, increased energy costs, and inflationary pressure. In QES Q4, 76% of businesses stated inflation as a factor of concern for businesses and 65% of businesses stated energy costs as a further factor of concern. This highlights the increased pressure firms are under from crippling inflation figures as well as the pressure to settle their energy bills this winter. However, the number of businesses reporting that energy costs were a cause for concern to their businesses was reduced to 65% in Q4, from 82% in Q3. Therefore, from the data we can see that the energy support package for businesses has relieved some of the pressure on them, albeit energy costs remain a significant challenge, dependant on further clarity by Central Government on price caps post March 2023.

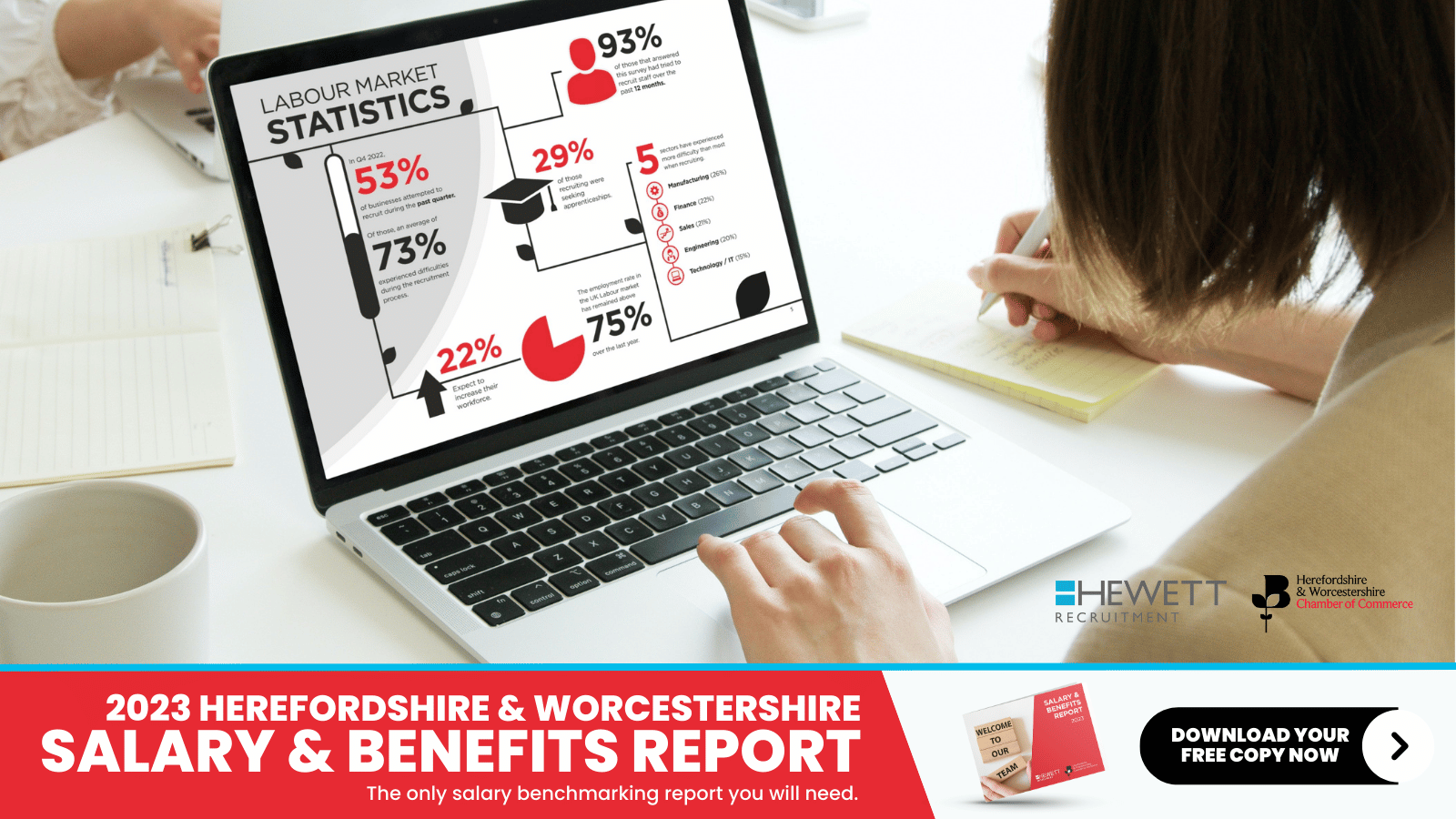

The most recent Office for National Statistics figures show an improvement in the UK labour market from the previous Salary & Benefits Report 2021/22. The UK employment rate for August to October 2022 increased by 0.2 percentage points on the quarter to 75.6% but is still below pre pandemic levels. Over the latest three-month period, the number of employees increased. The timeliest estimate of employees on the payroll for November 2022 shows another monthly increase, up 107,000 on the revised October 2022 figures, to a record 29.9 million, compared to 29.2 million last year. The unemployment rate was 3.7% compared to 4.2% last year (Labour Market overview, UK – Office for National Statistics, 2022).

The estimated number of vacancies fell by 65,000 in the most recent quarter to 1,187,000. Despite five consecutive quarterly falls, the number of vacancies remains at historically high levels. The fall in the number of vacancies reflects uncertainty across industries, as respondents continue to highlight economic pressures as a factor in holding back on recruitment. Therefore, the challenging labour market seems destined to continue as the cost-of-living crisis shows no sign of easing in the next few months (Labour Market overview, UK – Office for National Statistics, 2022).

In the current challenging labour market, it is as vital as ever for businesses to review the pay and benefits packages that they offer to employees. The data shows that businesses in Herefordshire & Worcestershire are struggling in recruiting for all sectors and this report will hopefully assist your work on recruitment and retention. The Chamber will continue to provide advice and guidance to businesses to help them through the current challenging times.

Laura Hewett, Owner/Director of Hewett Recruitment, commented on the Salary & Benefits Report 2023, and said “The launch of the Salary & Benefits Report 2023 seems to have been more anticipated than ever this year, with well over 300 companies sharing their data. The double-digit inflation rate and its’ impact on the cost of living, has put further financial pressure on businesses competing to attract and retain employees. People are more likely to have their heads turned for salary growth, whereas 6 months ago other factors may have weighed heavier in their decision making. Companies are clearly keen to keep pace with these demands, whilst carefully balancing costs as we head into a likely recession.

The word ‘recession’ often conjures visions of mass-unemployment. However, given the scale of the skills shortage and the sizeable gap between supply and demand of skills, the predicted softening of the economy will still leave us with similar labour market challenges. So… now is not the time take our foot off the gas when it comes to finessing our employee offering.

That said, once compensation packages are where they need to be, pay alone will not keep people engaged in employment. We all know that people don’t leave companies, they leave bosses. That is because no-one has a greater impact on a worker’s day-to-day experience and attitude than their direct manager.”

Operating in a challenging labour market brings its challenges for businesses who are looking to retain and recruit staff. To find out more about how to overcome these obstacles, download your free copy of the report.

If you have any questions in relation to the report, please contact the Policy department at the Chamber at [email protected].