Supporting UK Businesses with CBAM compliance

CBAM Consultancy Service

The European Union’s (EU) Carbon Border Adjustment Mechanism (CBAM) has introduced new compliance requirements for importers bringing certain goods into the EU. These regulations mean that UK exporters must provide accurate emissions data to support their EU customers in fulfilling their reporting obligations.

UNDERSTANDING CBAM?

It is essential for businesses to understand the requirements of the Carbon Border Adjustment Mechanism (CBAM) and to take the necessary actions to ensure full compliance.

WHAT IS CBAM?

The Carbon Border Adjustment Mechanism (CBAM) is an EU regulation designed to prevent carbon leakage and encourage greener global trade. It places a carbon price on imported goods, ensuring they face similar carbon costs as EU-manufactured products.

WHO DOES IT APPLY TO?

CBAM applies to carbon-intensive sectors, including; Cement, Iron & Steel, Aluminium, Fertilisers, Electricity and Hydrogen.

WHY ACT NOW?

To maintain a competitive edge and avoid trade disruptions, UK businesses must be prepared to accurately calculate and report emissions data associated with their exports.

HOW CBAM WORKS

To comply with CBAM, UK exporters must calculate the total embedded carbon emissions in their products, covering both direct and indirect sources. Direct emissions arise from on-site activities such as fuel combustion, chemical reactions, and the generation of heat or steam. Indirect emissions result from purchased electricity, even if generated off-site, as they still contribute to the product’s carbon footprint. Exporters must also document and report any carbon costs already paid within the supply chain.

2023-2025

This is the transitional phase.

EU importers must submit quarterly reports detailing the carbon footprint of imported goods.

2026

This is the definitive phase.

Importers must purchase CBAM certificates to account for any emissions not covered by a carbon price in the country of origin.

2027

The final phase.

The UK is expected to introduce its own CBAM regulations, making it even more important for businesses to prepare now.

HOW WE CAN SUPPORT UK BUSINESSES

The CBAM Consultancy Service equips UK exporters with the tools and insights needed to comply with these evolving requirements. Our expert consultants guide businesses through understanding, calculating, and reporting their carbon emissions in line with the latest regulations. Our services include:

TAILORED CBAM ASSESSMENTS

A specialist will review your operations and supply chain to evaluate the carbon impact of your exported goods.

ON-SITE OR REMOTE CONSULTANCY

Work directly with CBAM specialists to establish a compliance framework suited to your business.

EMISSIONS DATA REPORTING SOLUTIONS

Implement a structured CBAM monitoring system to ensure your EU customers receive accurate and verifiable data.

CBAM SOFTWARE TOOLS

Businesses will receive an initial 12-month licence for the CBAM software used to track and report emissions effectively.

Meeting CBAM requirements helps ensure smooth trade with EU partners, reduces compliance burdens for EU importers—making UK goods more competitive—and highlights opportunities to cut emissions and improve sustainability. It also positions businesses to be ready for the UK’s own CBAM legislation, expected from 2027.

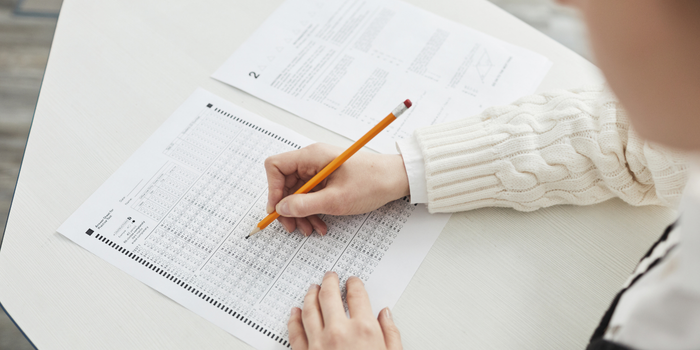

CBAM HEALTH CHECK TOOL

The BCC’s CBAM Health Check Tool is a free, interactive resource designed to help UK businesses evaluate their preparedness for CBAM compliance.

If your business exports to the EU, understanding your carbon emissions reporting obligations is essential for maintaining trade relationships.

Answer a few quick questions – The tool takes 5 minutes to complete.

Receive a personalised readiness report – Your results are displayed using a traffic light system to highlight:

Urgent areas requiring action

Areas needing improvement

Compliance areas already in place

If further support is needed, businesses can book a free session with a CBAM expert.

INTERNATIONAL TRADE TRAINING COURSES

The Chamber is proud to supplement its expert International Trade advice with a detailed course portfolio that attracts businesses from all sizes and sectors. Our courses are aimed at all company personnel involved with and/or have and understanding of customs procedures in International Trade.

-

Discount For Members

Discount For MembersHow To Export To Northern Ireland

11th Jun 20261:30pm to 4:30pm£200.00+VAT

£160.00+VAT

View Event -

Discount For Members

Discount For MembersCustoms Procedures and Documentation

19th Mar 20269:30am to 3:30pm£300.00+VAT

£240.00+VAT

View Event -

Discount For Members

Discount For MembersUnderstanding Export and Export Documentation

15th Jul 20269:30am to 3:30pm£300.00+VAT

£240.00+VAT

View Event -

Discount For Members

Discount For MembersAn Introduction to Export and Import Procedures

11th Mar 20279:30am to 3:30pm£300.00+VAT

£240.00+VAT

View Event

Become a Chamber Member!

Contact our Chamber Membership team to find out how we can help your business.